14th October 2020

DEASP BUDGET 2021 Fact Sheet

€25.1bn to be spent on Social Welfare in 2021

- Largest ever annual allocation to the Department of Social Protection

- Budget provides increases to vulnerable people with the greatest need

- Resources focused on pensioners, carers, people with disabilities, families and jobseekers

- Pension Age to remain at age 66

- Carers Support Grant increased by €150 next year to €1,850

- Increase in qualified child payment for almost 420,000 children dependent on social welfare

- Over 375,000 to benefit from increased fuel allowance

- 2020 Christmas Bonus extended to PUP and Jobseeker recipients with 15month requirement reduced to 4months as an exceptional measure

Living Alone Allowance

Minister Humphreys is increasing this allowance from January next by €5 to €19 per week for older people, widows, widowers and people with disabilities. Over 210,000 people will benefit from this increase. This is an additional investment of over €54 million a year in supporting those who are living alone.

Fuel Allowance

In comparison with other years and in recognition of the need to protect vulnerable people and to suppress Covid-19 the Minister recognises that people have had to remain in their homes for longer than they normally would have done. The Minister is therefore increasing the weekly Fuel Allowance rate by €3.50 from January next to €28 per week. Over 375,000 people will benefit from this increase.

Pension Age

The Minister formally announces that the State pension age will not increase to 67 years from January as originally planned and that legislation will be introduced later this year to reverse the rise in pension age that is currently included in social welfare legislation.

Carer’s Support Grant

Over 130,000 carers will benefit from the €150 increase in the grant, which is paid in June each year. This is the highest rate at which it will have been paid since the introduction of the grant.

Qualified Child Increase

The Minister acknowledges the research of the Vincentian Partnership, which shows that the cost of raising children, particularly older children, is a significant factor in determining income need. Consequently, the weekly payment for a qualified child aged 12 or over will increase from €40 to €45, while the payment for a child aged under 12 will increase from €36 to €38. These changes represent increases for over 419,000 children in households, which are dependent on social welfare and will take effect from January 2021.

Working Family Payment

In recognition of the need to continue to support low-income working families, the Minister is increasing the income thresholds by €10 per week for families with up to 3 children.

One Parent Family Payment

In order to ensure that parents raising children on their own can earn more than €425 per week and retain their payment, the Minister is removing the earnings limit. This will be effective from April 2021.

Disability Allowance

The Minister is increasing the earnings disregard on Disability Allowance from €120 per week to €140 per week with effect from June 2021. This will improve the incentive, where appropriate for people in receipt of Disability Allowance to take up work and remain in employment.

Employability Service

The Minister is extending the training support grant of €1,000 to jobseekers who avail of the Employability Service. This payment will help support access to the workplace.

Widowed or Surviving Civil Partner Grant

This grant greatly assists widows, widowers and surviving civil partners with children following the death of their partner. Therefore, the Minister is increasing this grant from €6,000 to €8,000.

Parent’s Benefit

The Minister is announcing that payment of Parent’s Benefit, which amounts to €245 per week will be increased from 2 weeks to 5 weeks from April and that it will apply in relation to all children born since November 2019. This payment is available to both parents.

Illness Benefit

The Minister is reducing the waiting period to three days so that people can be paid from their fourth day of illness. This will reduce the financial strain and allow people to take time off work when they are ill without the loss of income currently experienced. Please note there are currently no waiting days applied to applications for Covid-19 Enhanced Illness Benefit.

Pandemic Unemployment Payment

The Minister recognises the risk that recipients of PUP who were self-employed face in restarting their business. In order to reduce the risk of moving from the certainty of the PUP payment to the uncertainty of trading income, the Minister is enabling self-employed people on PUP, including those who work in the arts/entertainment industry, taxi drivers and others, to recommence work and earn up to €480 per month, while retaining their full PUP entitlement.

In addition, the Minister is making the Part-Time Job Incentive scheme available to self-employed people who come off PUP or a jobseeker’s payment. This scheme allows a person to receive a partial jobseeker’s payment, while retaining employment income. This may be particularly suited in circumstances where a self-employed person’s income exceeds the €480 per month income threshold on PUP.

Christmas Bonus

The Minister is announcing that the 2020 Christmas Bonus will be paid this year at a rate of 100%. This bonus payment recognises the needs of people who are long-term financially dependent on their social welfare payment for all or most of their income.

However, in light of the exceptional circumstances arising from the pandemic and on a once off basis, this year, the bonus will be paid to certain PUP and Jobseeker recipients who are currently in receipt of these payments and have been for at least 4 months.

A full list of today’s measures can be found in the Budget Factsheet at www.gov.ie/deasp

23rd July 2020

The Government has today announced the July Stimulus package to support small companies, jobs, and society. It is vital to support our small businesses at this difficult time and to invest to get people back to work. The recent restrictions have been necessary but difficult. Fine Gael will do what we can for businesses and workers who are struggling at this time.

Here are some of the new measures that were announced today:

- The Pandemic Unemployment Payment will be extended until April 2021 with a new three-rate system in September.

- €75 million so that every school in Ireland will receive a grant to support vital works to help with health and safety of students. Additional financial support will be given to special schools and schools with special classes.

- VAT will be reduced from 23% to 21% until the end of February 2021.

- €40 million for new cycling schemes.

- Up to €4,000 for individual sports clubs in Ireland as part of a €70 million grants package.

- Commercial rates for small and medium businesses are waived until September.

- A new Employment Wage Support Scheme will support wages for 350,000 workers in businesses with turnover down by 70%.

- The maximum payment under the expanded Business Restart Grant will rise to €25000.

- The tax refund under Fine Gael’s Help to Buy Scheme will increase to €30,000 as promised and the threshold will rise to 10% for the remainder of 2020.

- A ‘Stay and Spend’ tax credit of up to €125 available to individuals when €600 or more spent on accommodation, food or non-alcoholic drinks during a holiday in Ireland.

Full details of all the measures can be seen here: https://www.gov.ie/en/publication/c48ab-july-jobs-stimulus/

Planning Application

May 2020

PLANNING AND DEVELOPMENT ACT 2000 (SECTION 38) REGULATIONS 2020.

The Minister for Housing, Planning and Local Government, Mr Eoghan Murphy T.D., has made Regulations entitled as above.

The Regulations are made under section 38 of the Planning and Development Act 2000, as amended.

This Regulations supplement the Planning and Development Regulations 2001 so that Planning Authorities are required to make planning applications available for inspection on their websites within five working days of the receipt of a planning application.

Copies of the Regulations can be purchased directly from the Government Publications Office, 52 St. Stephen’s Green, Dublin 2. Phone: 076 110 6834.

Department of Housing, Planning, and Local Government.

CLIMATE CHANGE

Greenhouse gas emissions from Irish power generation and industrial companies fell by 8.7% last year and we will do more in future too..

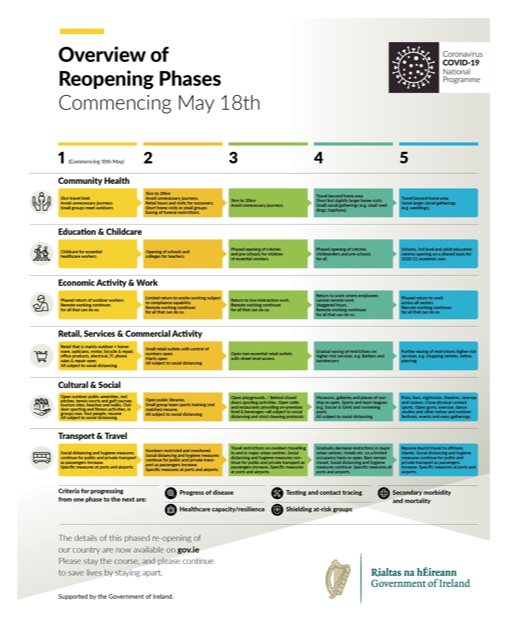

Roadmap for opening Ireland from May 18th

LEAVING CERTIFICATE 2020

Following yesterday’s announcement postponing the sitting of leaving certificate 2020 and todays cabinet meeting, the Minister for Education has announced the following measures which will replace this year’s traditional sitting of the leaving certificate.

All students to be offered the option of accepting Calculated Grades or sitting Leaving Certificate written examinations at a later date. The following is a breakdown of the process to be applied for students to be given the option of Calculated Grades or to sit the examinations.

1. The 2020 Leaving Certificate examinations, previously scheduled to take place in late July and August, have been postponed.

2. There will be no Leaving Certificate fee this year. All exam fees which have been paid will be refunded.

3. Teachers will be asked to provide a professional judgement of each student’s attainment which will be subjected to a rigorous in-school alignment process to ensure fairness.

4. The school principal will approve the estimated scores being provided and the rankings of each student in each subject in the school.

5. A special unit is being established within the Department of Education and Skills to process the data provided by each school and operate national standardisation, again to ensure fairness amongst all students.

6. The department will finalise the grades for each student which will be issued to each student as close as possible to the traditional date. Formal State certification will also be provided.

7. Students will retain the right to appeal. This will involve checks on school-entered data; correct transfer of that data to the department; a review that it was correctly received and processed by the department; and a verification of the department’s processes by independent appeal scrutineers.

8. Students will also retain the right to the sit the 2020 Leaving Certificate examinations at a date in the future when it is deemed safe for state examinations to be held.